Most foreign entrepreneurs are attracted by the investment legislation Malta enabled. However, there are also other reasons foreign investors choose Malta as their preferred country of doing business, one of them being the flexibility of the incorporation procedure and types of business entities available for registration. Company formation in Malta falls under the Maltese Company Act of 1995 which establishes the requirements for a business to be set up. Our team of company formation specialists in Malta can offer complete support at the time of company registration for both local and foreign investors in Malta.

What types of companies can you register in Malta?

The Commercial Code regulates the following types of Maltese companies:

- • limited liability companies that can be public or private;

- • partnerships which can be general or limited.

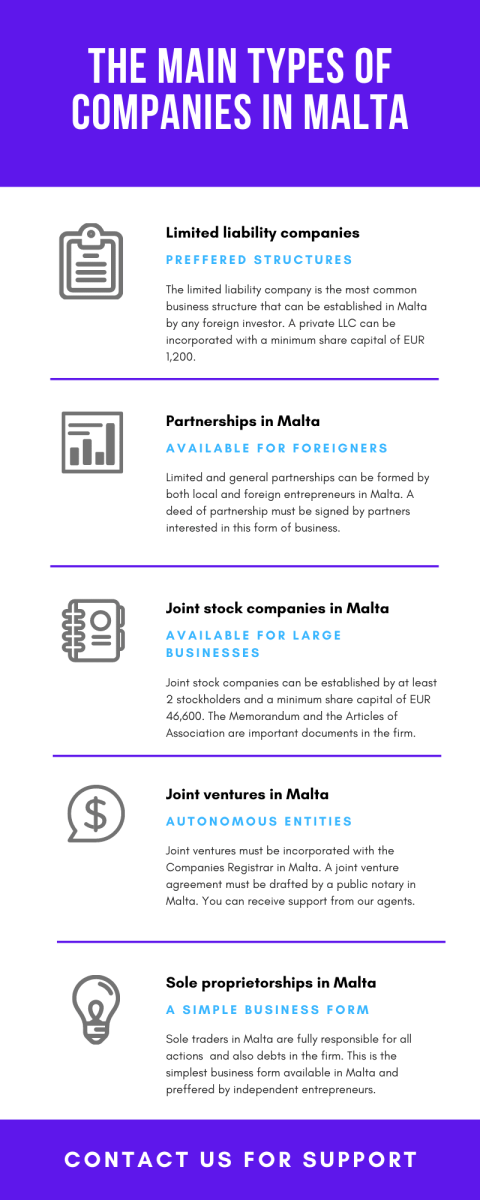

Among these, the most employed type of company in Malta is the private limited liability company because of the minimum requirements for setting up this type of business. Here is an infographic that explains more:

Private and public companies in Malta

Maltese limited liability companies can be private or public. The main differences between the two types of companies reside in the share capital requirements and the fact that the public company can list its shares on the Maltese Stock Exchange, while the private company may not. With respect to the share capital requirements, the Maltese private company must have a minimum capital of 1,200 euros, while the public company will have a minimum share capital of 47,000 euros of which 25% must be paid upon incorporation. If the private company’s share capital exceeds the minimum amount required the founders will only be asked to deposit 20% of the amount upon registration with the Maltese Commercial Register. The maximum number of members in private companies is limited to 50. More about how to open company in Malta and cost can be offered by our agents.

How can I register a partnership in Malta?

Partnerships in Malta can only be initiated by two parties entering a deed of partnership. The Commercial Law recognizes two types of partnerships: the general and the limited partnership. In the case of general partnerships, the members will be held jointly and severally liable for Maltese company’s debts and obligations. Limited partnerships will be formed of a general and a silent partner. The general partner will be fully liable for the company’s debts and obligations, while the silent partner will be held accountable to the extent of his contributions.

What are the documents for company incorporation in Malta?

According to the Maltese Law, the Articles of Association are the main documents of a company in Malta, which comprise information about the owners, the name of the business, the board of managers, the purposes and the activities of the firm, and details about the capital contribution of each member. Considering the importance of above-mentioned documents, we suggest you talk to one of our advisors if you want to open a company in Malta.

Can I set up a branch in Malta?

Yes, foreign companies can set up branches in Malta through limited liability companies, the type of structure mostly used for any kind of activity. Besides the Articles of Association, a document that mentions the intention of opening a branch in Malta from the foreign company is necessary. Setting up a branch in Malta means:

- • lower registration costs for this type of entity in Malta;

- • there is no need for a minimum share capital at the time of registration;

- • there are no withholding taxes on royalties, dividends, and interests;

- • the double taxation treaties are applicable for branches in Malta.

Can I establish a subsidiary in Malta?

Yes, subsidiaries in Malta can run under the conditions of a limited liability company and a minimum share capital or EUR 1,200 for a private entity. It is good to know that subsidiaries in Malta are independent entities compared to branches and the registration is subject to simple formalities. The Articles of Association, the business structure, the name of the legal representative of the firm, plus information about the rights and responsibilities in the company are among the requirements for establishing a subsidiary in Malta. Let our advisors take care of company formation in Malta and of VAT registration.

You can watch below a short video about the types of companies you can register in Malta:

Can I buy a shelf company in Malta?

Yes, foreigners can skip the formalities for registering a business from scratch and instead of that, they can direct the attention to shelf companies in Malta. These are ready-made companies already incorporated in Malta and available for business at any time. The advantage of a shelf company in Malta is that the ownership is transferred within a few days as soon as the documents have been accepted by the Maltese authorities. The confidence in front of the financial institutions in Malta is extremely important for those having a shelf company and looking for financial credits. A ready-made company in Malta is among the business choices for foreigners wanting to start a company in Malta. Feel free to address to our consultants for support and information about how to open a company in Malta and costs.

Asking for virtual office services in Malta

If you do not want to open a company in Malta and you do not need a traditional office, you can direct your attention to virtual office services. Such packages come with a notable business address in any important city in Malta, mail collection and forwarding, incoming and outgoing faxes, the collection of bank statements on request and call redirecting as agreed with the owner of the business. We are at your disposal with information about the virtual office services in Malta and the ways in which you can obtain them.

What is a Malta Gaming Company?

Known as a significant destination for gaming activities, Malta offers the possibility of establishing a particular type of business, also formed as a limited liability company. This is known as a Malta Gaming Company for which a Remote Gaming License is necessary, depending on the type of operations you want to set up. Among the benefits of such company, we mention the small licensing costs and the tax regime which are among the lowest in Europe. Interested in how to open a company in Malta cost? Talk to our agents.

Steps of opening a startup company in Malta

Malta has an appealing startup ecosystem that hosts a large number of innovative companies and many more. Both domestic and international entrepreneurs can easily register startups in Malta, helped by one of our specialists. The incorporation of a startup is about the same as the registration of any kind of business structure. The process starts with the verification of the business name, the formation of the Articles of Association with details about the owners, business address, activities, owners, etc. The registration for taxation is required, and if your new business is subject to specific licenses and permits, these must the obtained in the first place.

The limited liability company and the sole proprietorship are both excellent business structures that can be selected for your future startup in Malta. As for the sectors in which your new company can activate, you can choose the IT field, finance, research and development, tourism, FMCG and many more. The incorporation of a startup in Malta might seem complex for new entrepreneurs on the Maltese market, especially for foreigners, yet, our complete support is at your disposal right from the beginning. All the formalities involved can be attentively handled by one of our experts in the field.

Open a crowdfunding company in Malta

Another good startup idea can be a crowdfunding company in Malta. Such business can activate under the rules of limited liability company, and with a minimum share capital of EUR 1,200. Moreover, a website is required for such a business, in order to provide access to investors from around the world to your products. If you would like to know more about crowdfunding companies in Malta, please feel free to get in touch with us. Our specialists are ready to help you start your business in Malta, mentioning that we comply with the Commercial Code. Details about cost to open a company in Malta can be offered by our team.

Maltese trusts

Maltese trusts can be easily registered if the rules in this direction are followed, according to the Malta Financial Services Authority. Among them, a trust deed is needed to mention all the details about the trustee and beneficiary, plus the roles of that trust. However, it is important to consider specialist help in order to be able to register a Maltese trust correctly, especially if you are a foreign entrepreneur.

Joint-stock companies in Malta

A joint-stock company can be set up in Malta by at least two shareholders, either companies or individuals, with a minimum share capital of EUR 47,000, deposited in a local bank. This structure can have two directors and a secretary, according to Maltese Commercial Law. As for the registration of joint-stock companies, it is done after preparing Articles of Association and obtaining the necessary licenses, where appropriate.

In order to be sure that this structure is set up correctly, we recommend that you turn to the specialized help offered by our company formation team in Malta. We are at your disposal with all the necessary support throughout the registration process.

Holding companies in Malta

Foreign entrepreneurs who want to have control over other companies can set up Maltese holding companies. As the taxation system is advantageous, this structure is among the favorites of foreigners interested in business in Malta.

EUR 1,200 is minimum share capital for a private limited company or EUR 47,000 for a public limited company, the optimal structure for setting up a holding company in Malta. As for the registration process, it can take about 3 days but can be extended if other approvals are needed. In any case, we remind you that our team of specialists can offer you the necessary support related to the formalities of this business structure in Malta. Plus, you can ask us about the cost to open a company in Malta.

A liaison office in Malta

If you want to promote the activities of a foreign company in Malta, then you can set up a liaison office. Such a structure allows communication between the foreign company and potential customers in Malta, but apart from having commercial activities. In addition, this structure does not allow invoicing or signing contracts with suppliers but can do market research, can promote the products and services offered, and can develop business relationships with various employees.

This is another structure that can be registered with the help of our local agents, who are at your disposal with any kind of information, including cost to open a company in Malta.

A brief summary of the types of companies in Malta

So, there are many types of companies that you can set up in Malta, depending on your activities, projects, and objectives. Below you will find a summary of these types of companies, so you can get an idea before registering a structure, with the help of our specialists:

- Private limited liability company – EUR 1,200 as minimum share capital and at least one shareholder.

- Public limited liability company – EUR 47,000 and no more than 50 shareholders.

- General and limited partnerships in Malta – General partners are responsible for debts and obligations in the company.

- Branch in Malta – Can operate under the rules of limited liability company, with affordable costs, without minimum share capital.

- Subsidiary in Malta – Independent entity, can be registered with a minimum share capital of EUR 1,200 and simple formalities.

- Shelf company in Malta – Company already registered, has no activities, and no debts. It can be activated as soon as the documents are registered.

- Crowdfunding company in Malta – Suitable for startup ideas, you can register it with a minimum share capital of EUR 1,200.

- Joint-stock company in Malta – Choosen by the owners of large companies, interested in tailor-made investments.

- Holding company in Malta – For those who want to have control over other companies and benefit from lower taxes.

- The liaison office in Malta – An entity without financial activities, it can be used to promote foreign companies and present products and services in Malta.

FAQ about companies in Malta

1. What types of companies can I register in Malta?

The limited liability company is the proper business structure chosen by most entrepreneurs in Malta. Still, there are other forms available, such as, joint stock companies, partnerships, sole proprietorships, to name a few. Our team can help you choose the proper business structure for your activities.

2. What is the minimum share capital for LLCs in Malta?

EUR 1,200 is the minimum share capital for a limited liability company in Malta. This must be deposited in a local bank account which will serve as the main account for future business operations.

3. Can I open a branch or a subsidiary in Malta?

Yes, foreign investors can establish branches and subsidiaries in Malta with respect to the conditions imposed by the Maltese Company Act. Each structure has its characteristics and advantages, but for more details, you can talk to one of our agents.

4. When do companies pay VAT?

If the annual turnover with an exit threshold of EUR 28,000 and the entry threshold of EUR 35,000 is registered by a company with goods and services supply in Malta, then the registration for VAT is mandatory. All the details about the taxation in Malta can be offered by one of our company formation specialists in Malta.

5. Can I register a partnership in Malta?

Yes, partnerships in Malta are accepted as long as two entrepreneurs sign an agreement, mostly referred to as a deed of partnership. Limited and general partnerships can be easily established in Malta, mentioning that one of our specialists can help.

Investments in Malta

With a population of approximately 493,000 citizens, Malta is an insular state that offers plenty of business opportunities. More than EUR 18 million represents the exports of goods and services, while the imports sum up to around EUR 15 million. The skilled workforce, the good infrastructure, and the appealing business sectors are key points in Malta, making many international investors choose this country for business. Here are other important facts and figures that might attract your attention:

- Malta ranks 84th out of 190 economies in the world, according to the 2019 Doing Business report.

- More than 200 foreign companies are established in Malta;

- Around EUR 26,000 is the GDP (Gross Domestic Product) per capita at current prices.

- The exports of agricultural products in Malta worth around EUR 128 million, according to statistics for 2019, provided by the European Commission.

Why work with our specialists

Our team of agents has experience in setting up and registering companies in Malta. Collaboration with the relevant authorities in these processes, but also the creation of documents are important aspects that can be handled by our specialists. Efficiency, trust, and professionalism are attributes that we rely on when we collaborate with our clients, in order to offer them the best results.

Doing business in Malta comes with a series of benefits, like easy incorporation and the possibility of choosing the type of structure that suits most. You can talk to our agents for comprehensive and dedicated support. For additional information about the available types of companies and cost to open a company in Malta, please contact our agents in company formation in Malta.